A lot of election postmortems have made claims like policy doesn’t matter or that deliverism has failed. That voters do not care about policy and in fact the important thing is that Democrats must figure out how to control messaging. It is similar thinking to the claim that we had not been in a recession in 2022 and 2023, but instead a “vibescession.” And it’s true, in 2022 and 2023 in the absence of an actual employment and output recession, consumer sentiment went down drastically. The view here, espoused by many people in the Democratic party, is that the media was unfairly representing the strength of the economy.

But there was mostly not a vibescession. Or more concretely, yes, there was not a recession as it is typically defined because people kept working and real output was maintained thanks to large amounts of government spending and high demand. But the consumer sentiment we witnessed under the Biden Administration was perfectly in line with historical economic sentiment when measured with a broad set of indicators, with a reasonable rate of decay in the importance of the numbers.

I’ll get to the data in a moment and then walk through what I did, but the important thing here is that it is probably the case that deliverism is not dead, Democrats just failed to deliver voters what they wanted. And I don’t blame the Biden administration for much of what happened economically, a global supply shock that throttled incumbent governments across the globe. But it’s important not to delude ourselves about what people felt and why. People hate inflation, we had a lot of it, and we lost. In a way that is optimistic: don’t hit the inflation button next time! But it happened.

Show me the charts! Okay, here is a model of the University of Michigan’s consumer sentiment data predicted by a bunch of economic variables I selected to reflect growth, inflation, and employment. The data is for the previous 15 quarters, decayed by 17% per quarter and given a weighted average. 15 quarters were selected because that is how many are in a presidential term before the election. And the 17% decay I chose because I remember reading somewhere that was a good amount of decay and it feels intuitive: people care about last year about half as much as they do this year and two years ago about 25% as much as they do today.

These are all standardized values so they reflect z-scores (1 standard deviation) for each variable. Additionally, for the last two quarters I added 9 points to the Michigan sentiment data to reflect the mode effects articulated by Ernie Tedeschi, namely Michigan switched to online panels from phone panels and got more negative.

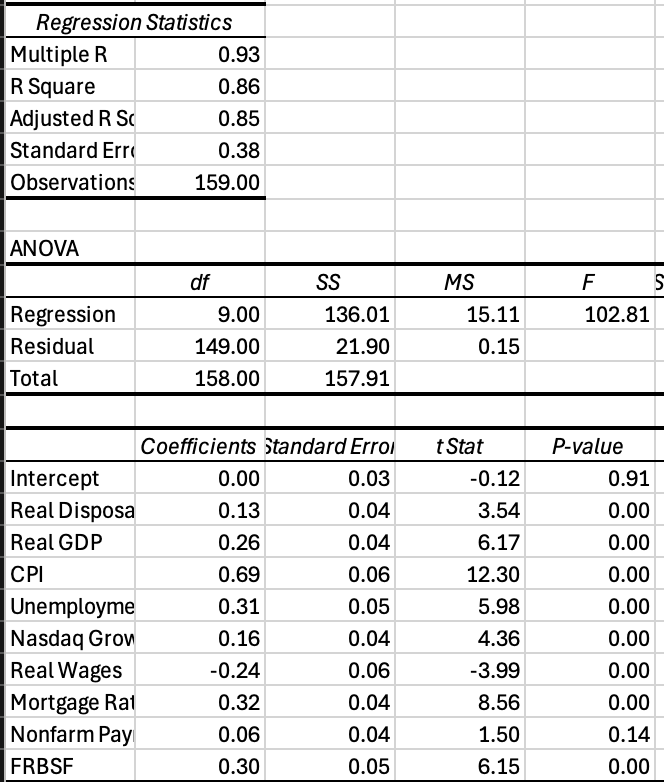

Pretty good. And here are the coefficients in the linear regression output.

CPI and unemployment were inverted so lower is better. I chose NASDAQ because it was available on FRED. Anyway, pretty good! Explaining 80+% of the variance. CPI and Unemployment matter the most! And notice just how negative sentiment was predicted to be in 2022. People hated the economy just like you would have expected they would in 2022 and 2023. When was it a bit unfair? At the end of the term.

So let’s add in a measure of vibes.

The San Francisco Fed publishes a daily news sentiment index. Let’s add that in and see if it helps:

It does! The regression has a stronger correlation and it closes the gap a bit. Even controlling for all the other variables, a one standard deviation change in the news sentiment index has a .3 standard deviation impact on consumer sentiment. Of course, this may reflect that the news sentiment is picking up data not reflected in my variables. Vibes mattered! But, you know, not that much.

I wanted to check one other thing though: we know partisans, particularly Republicans, have become extremely expressive in their views of the economy. So let’s add a dummy variable to the regression that reflects how expressive Republicans have become in the post-Trump era:

Yes! That helps a bit and in particular makes the last 8 years make a lot more sense: Republicans have just decided to answer really positively when Trump is president and really negatively when a Democrat is president. But that doesn’t mean the hard data doesn’t matter or that it didn’t heavily impact independents and Democrats. I mean look at that regression. All of these variables are significant. I’m sure there are others that if I added them could increase the explanatory power a bit.

But for the most part even controlling for news sentiment, even controlling for Trump, hard data matters a lot for economic sentiment. People hate inflation, they like low employment and GDP growth. So sentiment wasn’t abnormal. Sentiment reflected that while job growth and unemployment matter, people just really don’t like inflation. Inflation is poison for incumbent parties and poison for social democracy. Yes I think we should and would tolerate 2.5% or even 3% inflation just fine. But we didn’t have that, we had a CPI that peaked at nearly 9% YoY in June 2022. Things had gotten much better but that memory had not faded completely by 2024, and so Joe Biden and then Kamala Harris lost.

This is pretty slick! Thanks! If you come back to this analysis in a later post, I'd love to see the trend in R^2 for this model over, say, years. I think this would get closer to directly evaluating the claim that this sort of model has been getting worse and worse at explaining variation in sentiment.

Another way to do this might be to use year dummies. (These might be collinear w the Trump dummy, though :/.) If the year-dummy coefficients aren't more or less significant in the past handful of years compared to the way-back-when years, then your hypothesis that the reduced form model is adequate for the post-pandemic years would be stronger, imo.

Thanks for actually crunching the numbers here! Good evidence that the answer for why Trump won is an answer that all partisans hate.